WGA Releases New Housing Finance Outlook

BRIARCLIFF MANOR, N.Y., April 22, 2024 (Newswire.com) - Whalen Global Advisors LLC published the latest edition of The IRA Outlook for Commercial & Residential Mortgage Finance. The report is available to subscribers to The IRA Premium Service and is also available for sale in IRA's online store. Some of the conclusions of the report include:

Commercial Reset: The commercial real estate sector is in the early stages of an epic change in valuations that is driven by a number of factors. While interest rates are an important reason for lower valuations, WGA sees asset-specific factors as more significant in many cases.

CapRates: Because of COVID rent moratoria, many multifamily properties entered 2023 impaired with owners that were unable or unwilling to add new capital. Progressive consumer legislation forgot the owners of apartments and badly impaired multifamily properties in cities such as New York, making banks unwilling to finance these buildings.

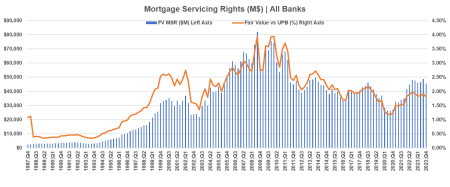

Residential: Even as many commercial assets come under sharp downward price pressure due to credit defaults and a general trend toward reducing office space, the $13 trillion residential sector remains relatively quiet, the report notes. Residential loan net loss rates are near zero for banks due to the Fed’s aggressive actions in 2019-2022, but WGA believes that a sharp residential home price reset is likely later in the decade.

“After the next drop in interest rates by the Federal Open Market Committee,” notes WGA Chairman Chris Whalen, “We'll see a modest uptick in home prices and residential lending volumes from today’s low levels, followed by a more traditional home price correction down to pre-COVID levels. We think that consumer credit will start to be a real problem next year.”

Whalen does not believe that even a modest decrease in interest rates will do much to change the episodic changes that are sweeping through the world of commercial properties. The report states that a low double-digit discount is a good starting price assumption when investors assess office properties.

“It is dangerous to generalize about CRE, but individual transactions suggest that a significant, double-digit price correction is underway,” the report notes. “New mortgage loans are being priced based upon cap rates north of 6-8x net operating income vs 2-4x in 2020-2022 period. Cap rate math is inherently deflationary.”

Copies of the IRA Outlook for Commercial & Residential Mortgage Finance are available to subscribers to the Premium Service of The Institutional Risk Analyst. Standalone copies of the report are also available for purchase in our online store. Media wishing to receive a courtesy copy of the report please email: info@rcwhalen.com

About Whalen Global Advisors LLC

Whalen Global Advisors LLC (WGA) is a New York-based consulting, risk analytics and publishing company that focuses on financial institutions and global markets. WGA publishes The Institutional Risk Analyst (ISSN 2692-1812), including commentary on the capital markets, industry reports, the WGA Bank Indices and company profiles. For additional information, please contact us at: info@rcwhalen.com

Source: WGA LLC