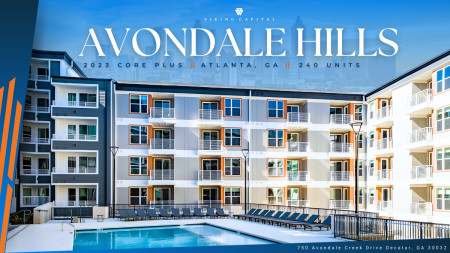

Viking Capital Announces New Investment Opportunity in Atlanta

ATLANTA, July 1, 2024 (Newswire.com) - Viking Capital is pleased to announce its latest multifamily investment opportunity, Avondale Hills. This 2023-built, 240-unit Class A asset is strategically located just outside of Atlanta, offering significant upside potential with below-market rents and premium amenities. Investors can expect immediate rent increases of $200 to align with the market, enhancing the property's appeal.

Acquiring Avondale Hills off-market and at a $20M discount significantly boosts its investment appeal. The property's strong cost basis ensures long-term financial stability and attractive returns. The property's new and modern construction, millennial-friendly design, and robust submarket fundamentals minimize risk, making it a secure and lucrative investment.

Avondale Hills is ideally situated directly across from a MARTA transit station, making it perfect for affluent renters who choose to live outside the city due to increasing housing prices. This prime location offers residents the advantage of lower rents while maintaining easy access to nearby employers and major tech companies, just a 20-minute ride away.

In the "path of progress," Avondale Hills benefits from strong economic drivers, an influx of Fortune 500 companies, and luxury shopping centers, providing excellent access to diverse employment opportunities. With over 2,000 units in Atlanta, Viking Capital leverages economies of scale to drive operational efficiencies and organic growth, including an opportunity to exit to an institutional investor at a high price.

To get the first look at our latest investment offering, join our live webinar and Q&A on July 9th at 7 p.m. ET.

For more information about Avondale Hills and Viking Capital's investment opportunities, visit https://www.vikingcapitalinvestments.com/avondale-hills.

Source: Viking Capital