Texas Small Business Defaults Unchanged in January

Chicago, IL, March 13, 2017 (Newswire.com) - In January 2017, the percentage of small firms late on repaying existing loans has remained consistent in Texas, data announced by PayNet shows. Of the 18 major industries, 7 improved and 11 worsened.

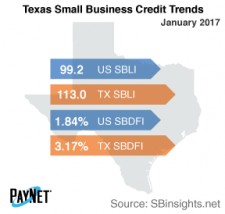

Following a 3 basis point decline from December, Texas' PayNet Small Business Default Index (SBDFI) of 3.17% ranked last nationally and was 133 basis points greater than the national SBDFI level of 1.84%. The decline in defaults over the past two months may signal improving financial health in the state. Texas' SBDFI rose 98 basis points over the last year, while the national SBDFI rose 29.

The industries with the highest default Index in Texas were Transportation and Warehousing (7.35%); Mining, Quarrying, and Oil and Gas Extraction (7.14%); and Construction (4.09%). Nationally, Transportation and Warehousing had a default rate of 4.23%, with a difference of +1.40% compared to the prior year variance of +2.04% in Texas.

Registering at 113, Texas' PayNet Small Business Lending Index (SBLI) rose 0.2% from the previous month's state level and was 13.9% greater than this month's national SBLI level. Year-over-year, business investment deteriorated 8.0%, reducing future growth potential.

"The performance of defaults over the past few months may foster a better lending environment," suggests William Phelan, president of PayNet.

Source: PayNet