Small Business Defaults in Massachusetts Up in April

Chicago, IL, June 9, 2017 (Newswire.com) - In April 2017, small business loan defaults increased in Massachusetts' business community, according to data published by PayNet. However, of the 18 major industries, only 7 rose in the state.

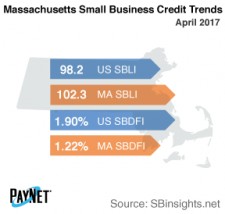

In spite of a 3 basis point increase from March, Massachusetts' PayNet Small Business Default Index (SBDFI) of 1.22% ranked 3rd best in the country and was still 68 basis points below the national SBDFI level of 1.90%. The uptick in defaults over the past four months may signal deteriorating financial health in the state. The national SBDFI increased 26 basis points over the last year, while Massachusetts' SBDFI rose 9 basis points.

The industries with the highest default rate in Massachusetts were Information (2.32%); Manufacturing (1.91%); and Public Administration (1.88%). Nationally, Information had a default rate of 2.64%, with a difference of +0.18% compared to the prior year versus a variance of -0.17% in Massachusetts.

The PayNet Small Business Lending Index (SBLI) for Massachusetts came in at 102.3, outperforming the national SBLI level (98.2) despite declining by 0.3% from the previous month's state level. Small business borrowers are being cautious and holding off on new investment.

"Declining investment and deteriorating financial health exhibited by Massachusetts' small businesses set the stage for a slowing economy," states the president of PayNet, William Phelan.

Source: www.paynet.com