Small Business Defaults in Louisiana Unchanged in June

Chicago, IL, August 9, 2017 (Newswire.com) - In June 2017, the percentage of small businesses defaulting on loans has not changed in Louisiana, data published by PayNet reveal. Of the 18 major industries, 11 improved and 6 worsened in the state.

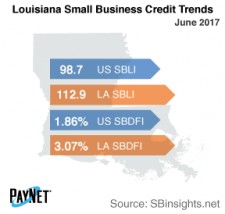

Following a 3 basis point fall from May, Louisiana's PayNet Small Business Default Index (SBDFI) at 3.07% was last nationally and was 121 basis points above the national SBDFI level of 1.86%. The decrease in defaults over the past two months may signal better business conditions in the state. Over the last year, Louisiana's SBDFI rose 43 basis points, which was a much sharper climb than the 16 basis point increase exhibited by the national SBDFI.

The industries with the worst default rates in Louisiana were Transportation and Warehousing (7.19%); Mining, Quarrying, and Oil and Gas Extraction (6.71%); and Agriculture, Forestry, Fishing and Hunting (4.49%). Nationally, Transportation and Warehousing had a default rate of 4.57%, with a difference of +0.68% compared to the prior year, while Louisiana had a variance of +2.37%.

The PayNet Small Business Lending Index (SBLI) for Louisiana was 112.9, outperforming the national SBLI level (98.7) and performing on par with last month's state level. Small business borrowers are cautiously increasing investment.

"Increased investment and improving financial health exhibited by Louisiana's small businesses set the stage for expansion," states the president of PayNet, William Phelan.

Source: www.paynet.com