Small Business Borrowing in North Carolina Stalls in April

Chicago, IL, June 13, 2017 (Newswire.com) - In April 2017, borrowing remained stagnant in North Carolina, according to data announced by PayNet. Of the 18 major industries, 13 fell and 5 rose in North Carolina.

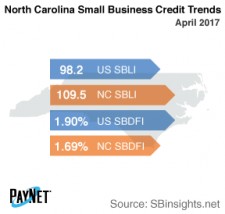

Coming in at 109.5, North Carolina's PayNet Small Business Lending Index (SBLI) exceeded the national SBLI level (98.2) and performed comparably to last month's state level. The index is basically unchanged from a year ago.

The three industries with the most unfavorable change in lending activity over the past year in North Carolina were Transportation and Warehousing (-15.8%); Public Administration (-15.1%); and Health Care and Social Assistance (-13.6%). Nationally, Transportation and Warehousing fell by -14.4% year over year.

At 1.69%, PayNet’s Small Business Default Index (SBDFI) for North Carolina was 21 basis points below the national SBDFI level of 1.90% after a similar performance to the previous month. Compared to last year, the national SBDFI rose 26 basis points, while North Carolina's SBDFI rose 13 basis points.

"Time will tell how these conditions will affect North Carolina's economy going forward," asserts William Phelan, president of PayNet.

Source: PayNet