RNDpoint to Launch ABLE Platform, Loan Management Software for Alternative Lenders and Banks

LONDON, September 8, 2021 (Newswire.com) - RNDpoint, a European provider of financial software solutions, announced the launch of ABLE Platform, a composable lending platform for automation of the entire credit lifecycle.

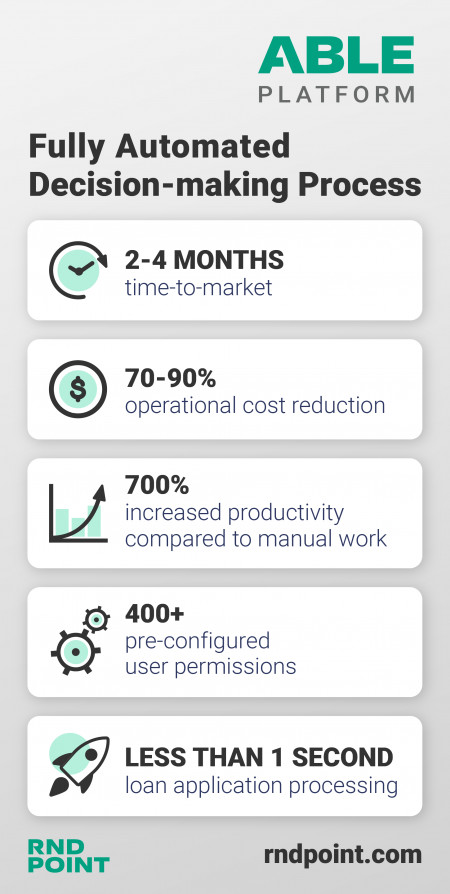

RNDpoint's web-based software platform digitizes lending, allowing banks and financial institutions to go digital in 2-4 months and launch additional new products in days rather than months.

The three core components of the platform include:

- ABLE Origination - loan origination software.

- ABLE Monitoring - early warning and customer management software.

- ABLE Collection - collections and recoveries automation software.

With an extensive out-of-the-box component structure, 400+ pre-configured permissions, automated decision-making, and control over design elements, ABLE Platform delivers flexibility for businesses to customize to suit their needs and that of their customers. The multichannel customer communication element takes users from onboarding to disbursement and everything in between, extending the customer experience.

Yuri Chekalin, Chief Product Officer at RNDpoint said:

"By using RNDpoint's new lending platform, our partners get pinpoint accurate lending decisions based on AI-technology and machine learning algorithms. The preconfigured functionality and low-code components used in ABLE Platform make it easily tunable for business users. In every implementation, we see how lenders are keen to make their customers' journey as smooth and seamless as possible. We kept this in mind while building ABLE Platform."

"Banks who have used ABLE Platform to automate their lending process confirm up to 90% reduction in operational efforts, compared to a manual process. They also mention that the capability of fully automated and AI-powered decisions allowed them to provide customers with immediate loan application confirmation," sums up Yuri.

About RNDpoint

RNDpoint has been successfully operating in the international financial market since 2014. With over 120 certified experts and a deep portfolio of financial software and services, RNDpoint has become the partner of choice for over 25 financial institutions worldwide. Our software products allow organizations to unlock digital transformation and work successfully with customers at every stage of their journey. For more information, visit www.rndpoint.com.

Contacts

Peter Shubenok,

CEO, Founder

info@rndpoint.com

Source: RNDpoint