Report: One in Three Amazon Sellers Increasing Ad Spend in 2022 in Increasingly Competitive Marketplace

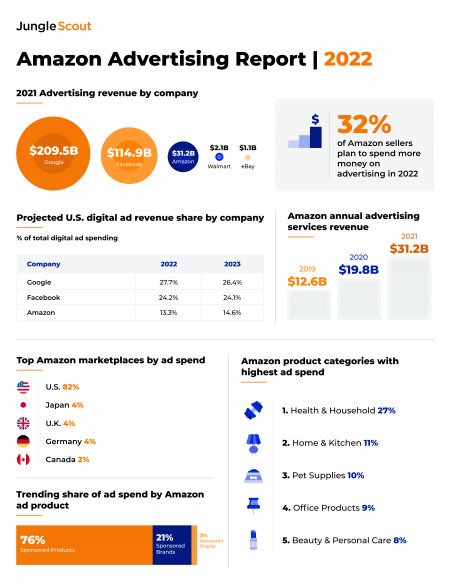

AUSTIN, Texas, May 18, 2022 (Newswire.com) - Today, Jungle Scout, the leading all-in-one platform for ecommerce sellers, released its 2022 Amazon Advertising Report, which examines Amazon's $31 billion advertising business, the third-largest in the world, after Google and Facebook. The findings show that 32% of brands and sellers on Amazon will increase their ad spend in 2022, despite concerns about rising advertising costs and challenges managing their strategy and budget.

The 2022 Amazon Advertising Report includes data from more than 5,000 distinct brands and 950,000 unique Amazon advertising campaigns, revealing trends, strategies, and ad products yielding the best returns on the platform.

Key insights include:

-

Amazon sellers are heavily investing in Amazon Advertising — out of necessity.

- While 63% of consumers begin their online search for products on Amazon (ahead of Google, Walmart.com or Facebook), this amount is down from 74% in early 2021.

- Forty-five percent of Amazon sellers say managing their advertising strategy and budget is a challenge for their business. As many as 94% experienced supply chain issues in 2021, in some cases leading to stock outages and reduced exposure on Amazon's platform.

- Thirty-two percent of Amazon sellers are increasing their Amazon advertising spend in 2022 to increase the visibility of their products and brands.

-

Consumer ad preferences correlate with impact on returns on ad spend.

- Amazon Sponsored Products, consumers' preferred ad type, saw a 68% return on investment. Sponsored Brands ads, consumers' least-preferred, saw a 41% decrease in return on investment in 2021.

- Consumers are being more effectively targeted off Amazon with Sponsored Display ads (which appear on third-party websites consumers in the U.S. are visiting), resulting in a higher share of advertising dollars.

-

However, high advertising spend doesn't always correlate with high returns.

- The Health & Household product category saw the highest ad spend but the lowest return on investment in the examined date range.

- Electronic products ranked second-to-last in ad spend and the highest in returns.

"The growth of Amazon's ecommerce and advertising business has resulted in increased competition for sellers and vendors on the platform. Organic promotion alone no longer provides sufficient reach," said Connor Folley, GM and co-founder of Downstream by Jungle Scout. "Sellers and brands have become aware of this shift and are increasing ad dollars to stand out from the pack. Access to the right advertising tools that help scale and automate strategy is a must to win in this quickly changing landscape."

Other insights include advertising spend and returns by:

- Marketplace: The U.S. marketplace makes up 82% of global advertising spend on Amazon, followed by Japan, the U.K., and Germany, each at four percent.

- Product price: In the examined date range, products priced between $41-$50 had the highest percent returns on ad spend.

- Ad targeting type, bidding strategy, and more.

See the full report for more details.

About Jungle Scout

Jungle Scout is the leading all-in-one platform for ecommerce sellers, supporting more than $40 billion in annual Amazon revenue. Founded in 2015 as the first Amazon product research tool, Jungle Scout today features a full suite of best-in-class business management solutions and powerful market intelligence resources to help entrepreneurs and brands manage their ecommerce businesses and advertising. Jungle Scout is headquartered in Austin, Texas, and supports 10 global Amazon marketplaces.

Media Contact

Milena Schmidt

Senior Manager, Communications

press@junglescout.com

Source: Jungle Scout