New Insights Into Why Power Producers Are Facing Unprofitable Growth

SAN MATEO, Calif., October 24, 2017 (Newswire.com) - Recent studies and interviews with hundreds of energy executives from across the global energy spectrum by Mercatus reveal that power producers are facing unprofitable growth despite increasing business opportunities in the renewable energy sector. While demand for renewables continues to surge; thanks to dropping technology prices, power producers today are struggling financially.

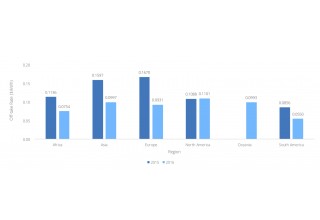

Due to the rapidly decreasing prices of solar and wind power, energy procurers today are becoming less inclined to enter into long-term power purchase agreements (PPAs). According to data from Mercatus Investment Lifecycle Management (ILM) platform, off-take rates are in decline globally. While this has proved beneficial for energy buyers, it is adversely affecting the power producer’s operating model, which is traditionally based on the assumption of long-term fixed-price contracts. As a result, their profitability is now trending downward for independent power producers (IPPs) in North America and Europe.

In this market, efficiency is key to profitable growth. To compete effectively, a lean cost structure and control over operating expenses is essential. Unless power producers focus on improving their productivity, they are at significant financial risk.

Haresh Patel, CEO, Mercatus Inc.

According to Haresh Patel, CEO of Mercatus, “The traditional Power Purchase Agreement and current Independent Power Producer business model are both under attack.”

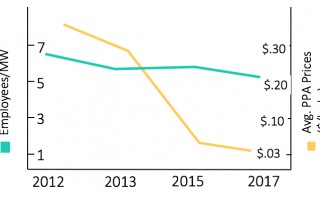

Mercatus also finds that companies that have expanded into distributed generation are suffering from flat-lined and even decreased employee productivity. Companies with distributed generation projects now require roughly seven times more full-time employees to achieve the same megawatt output than conventional energy sources. As a result, operating expenses are increasing within energy companies. This is severely affecting their profitability.

“In this market, efficiency is key to profitable growth. To compete effectively, a lean cost structure and control over operating expenses is essential,” adds Haresh Patel. “Unless power producers focus on improving their productivity, they are at significant financial risk.”

For more information on this research and findings, visit http://gomercatus.com/blog/power-producers-unprofitable-growth or contact Madeline Milani (mmilani@gomercatus.com).

About Mercatus

Mercatus is a cloud-based software company that serves the unique needs of renewable energy developers and asset owners. Mercatus Energy Investment Lifecycle Management (ILM) is the only integrated software platform that automates the full asset investment life cycle, from origination through end-of-life, enabling energy companies to grow their portfolio faster while lowering their risk profile. Mercatus’ customers are some of the largest energy companies that collectively leverage the Energy ILM platform to manage over 110 GW of projects, across 75 countries, using eight advanced energy technologies. Mercatus is headquartered in Silicon Valley and has offices in Europe and India.

Source: Mercatus Inc.