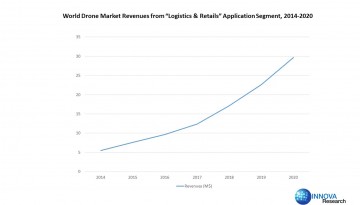

"Logistics & Retails" Remains as a Small Market for Drones

Shanghai, China, January 21, 2016 (Newswire.com) - In 2015, the world drone market revenue from “logistics & retails” application segment was estimated at merely USD 7.6 million, less than 0.5% of the total world market revenue for commercial drones in the year, and the “logistics & retails” is forecast to maintain as a small drone application segment, occupying less than 1.0% global drone revenue shares from 2016 to 2020, according to a market research report entitled “The World Market for Drones – 2015 Edition”, published by Innova Research. These data indicate that drone delivery and other logistics usage of drones will not become significant in the next five years.

In the past few years, a number of express delivery service providers and logistics companies started testing and trial services using drones as delivery tools. In 2013, UPS started “point to point” drone delivery testing within its own warehouses, and SF Express also started drone delivery within its own distribution networks in the same year. Besides, Amazon, DHL, Google were all reported to conduct similar projects for drone delivery. Drones can provide fast and cost-effective deliveries to remote, hazardous, or hard-to-reach areas. Apart from the logistics within corporates or facilities, drone delivery is also regarded to be an effective way in some other circumstances, such as for urgent medicine on-site delivery, last-mile delivery of critical components, urgent document deliver, among others.

However, there are still some barriers for drones to be used in the logistics and retail industries. First of all, legislation is the biggest obstacle. For example, in the USA, FAA (Federal Aviation Administraion) requires that drones must be in the sight of the operators. Flight safety is another issue, as the possible crash or failure of drones in crowded urban may cause large damage. Besides, the size of the items to be delivered must be small enough to fit in drones’ cargo boxes, and the weight must be light (typically less than 5 kilograms). There are also technology challenges for drones to identify and accurately land at the destinations they supposed to reach, due to the limitation of the GPS and other positioning technologies. Finally, the cost of drone delivery per time, the cost of the pilots, and the fees for drone maintenance are high. All these factors inhibit the massive adoption of drones for delivery services.

Richard Jun Li, Vice President of Innova Research commented: “Drone delivery is an interesting idea, but the massive adoption of drone delivery in the logistics and retail industries will not happen until the relevant legislation relieved, the positioning and other relevant technologies improved, and the cost of using and maintenance of drones reduced to an acceptable level.”