E-Commerce: Transforming India Retail & Service Sectors

Mumbai, India, September 23, 2015 (Newswire.com) - Indian Government’s Digital India initiative to boost e-commerce across country, says AMI

The proliferation of mobile devices combined with internet access via affordable broadband solutions and mobile data is a key factor driving the tremendous growth in India’s e-commerce sector. Mobile platforms have emerged as a major gateway for customer purchases as smartphones are increasingly replacing PCs for online shopping.

The success of vendors and website developers in helping SMBs meet their e-commerce goals depends on the former's ability to convince customers of the relevance and value of their solutions.

Neha Jalan Goenka, Senior Manager of Client Services

The surge in the growth of online retail transactions via marketplaces such as Snapdeal, Amazon and Flipkart is due to the underlying mobile technology and the ready availability of online access. Competition is heating up among online retailers. Even previously closed marketplaces are now opening up, encouraging smaller players to embrace e-commerce and list their products on their platforms thereby increasing product selection. Smaller players are likewise attracted by the incremental revenue potential arising from selling products via these online marketplaces which typically have a significantly large customer base.

Besides online marketplaces and online retail, other fast growing areas within the e-commerce sector include online travel, online deals and classified listings. Increasingly, the online route is being used for information-seeking and for making travel arrangements. A growing number of internet-savvy consumers are posting and accessing classifieds for jobs, large-scale purchases such as property, and even for matrimonial purposes. .

The Indian Government’s “Digital India” initiative is also expected to boost the e-commerce industry. The bulk of online transactions already arise from tier 2 and tier 3 cities. Once the Digital India project takes off, the government will deliver services via mobile connectivity and in doing so, is expected to bring the internet and broadband to remote corners of the country, thus providing the underlying connectivity for e-commerce. This will further expand the reach of the e-commerce market into India’s tier 4 towns and rural areas. Furthermore, the Indian Government is also modernizing India Post and aims to develop it as a distribution channel for e-commerce related services. This will significantly improve delivery services and cash transactions (via cash on delivery payment options) in more remote and rural areas, thus increasing the reach of e-commerce players and expanding the potential market.

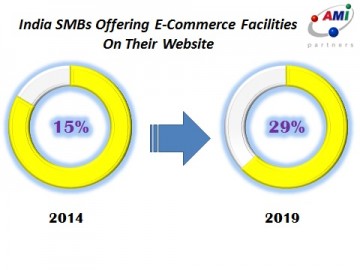

AMI-Partners research shows that small and medium businesses (SMBs) are increasingly investing in website development and maintenance, in order to achieve an online presence and offer online purchasing capabilities. According to AMI-Partners’ Global Forecast Model, 15% of India’s internet-connected SMBs have already launched a website with e-commerce capabilities. In the last year alone, SMBs in India spent $937 million on website development, hosting and maintenance.

“The next few years promise to bring about a transformation in technology usage among India SMBs as they embrace an online presence,” opined Neha Jalan Goenka, Senior Manager of Client Services at AMI. “The success of vendors and website developers in helping SMBs meet their e-commerce goals depends on the former’s ability to convince customers of the relevance and value of their solutions,” continued Goenka. With more and more businesses embracing e-commerce and many of the roadblocks such as connectivity and logistics being sorted out, AMI forecasts that by 2019, close to three in ten internet SMBs will offer online purchase facilities via their websites.

Related Study

AMI’s Global SMB Market Sizing and Forecast Model has been used by SMB marketers worldwide for more than 15 years. Delivered in pivot-table format, AMI’s forecast models enable data-driven marketing and sales decisions to be made with confidence and precision. The models drive customizable views through many filters—products, firmographics, adoption rates, ICT categories, spending levels and channels (routes to market). AMI’s models can be tailored to a specific taxonomy—whether related to ICT spending, firm size, installed base, shipments or other metrics. These tools provide SMB vendors, service providers and partners with consistency, and the ability to compare SMB data with internal sources—such as finance and sales—for further analysis. The models are a valuable asset for planning sessions, events, and company subsidiaries as well as corporate marketing and finance. AMI has recently extended its SMB models to encompass enterprise companies (LB, firms with 1,000 or more employees), home-based businesses and the public sector (government and education).

For additional information about AMI-Partners, our GM data models, or our global SMB and LB research visit www.ami-partners.com, call 212 944 5100 or e-mail ask_ami@ami-partners.com.

About Access Markets International (AMI) Partners, Inc.

AMI-Partners specializes in IT, Internet, telecommunications and business services strategy, venture capital, and actionable market intelligence—with a strong focus on global small and medium business (SMB) enterprises and extending into large enterprises and home-based businesses. The AMI-Partners mission is to empower clients for success with the highest quality data, business strategy perspectives and ―go-to-market solutions. Led by Andy Bose, the firm has built a world-class management team with deep experience cutting across IT, telecommunications and business services sectors in established and emerging markets.

AMI-Partners has helped shape the go-to-market SMB strategies of more than 150 leading IT, Internet, telecommunications and business services companies over the last ten years. The firm is well known for its IT and Internet adoption-based segmentation of the SMB markets, its annual retainership services based on global SMB tracking surveys in more than 25 countries, and its proprietary database of SMBs and SMB channel partners in the Americas, Europe and Asia-Pacific. The firm invests significantly in collecting survey-based information from several thousand SMBs annually, and is considered the premier source for global SMB trends and analysis.

Media Contacts:

Quoted Analyst: Neha Jalan Goenka. Phone: (91) 99300 20420. Email: njalan@ami-partners.com

Media Relations: In US (New York): Nancy Carty. Phone: (212) 944 5100 ext 581. Email: ncarty@ami-partners.com

In Singapore: Jackilyn Almazan. Phone: (65) 6521 3787 ext 115. Email: jalmazan@ami-partners.com

In India (Kolkata): Jyoti Singh. Phone: (91) 33 4003 3093 ext 223. Email: jsingh@ami-partners.com

In India (Bangalore): Rati Ghose. Phone: (91) 80 4148 2661 Email: rghose@ami-partners.com