Wisconsin Small Business Defaults Stable in April

Chicago, IL, June 14, 2017 (Newswire.com) - PayNet, the leading provider of small business credit assessments on private companies, reports that in April 2017, the percentage of Wisconsin's small businesses defaulting on loans has remained steady. Of the 18 major industries, defaults dropped in 12 and rose in 5 in the state compared to the previous month.

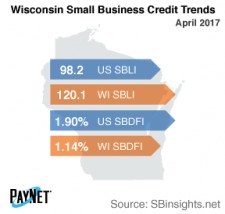

PayNet's Small Business Default Index (SBDFI) for Wisconsin ranked 2nd nationally at only 1.14% and was unchanged from March. Compared to the national SBDFI level of 1.90%, Wisconsin's SBDFI was 76 basis points less. The national SBDFI increased 26 basis points year-over-year, whereas Wisconsin's SBDFI dropped 14 basis points.

Transportation and Warehousing (3.26%); Mining, Quarrying, and Oil and Gas Extraction (1.99%); and Agriculture, Forestry, Fishing and Hunting (1.81%) exhibited the highest default rates of all industries in Wisconsin. Nationally, Transportation and Warehousing had a default rate of 4.54%, with a difference of +1.12% compared to the prior year versus a variance of -0.21% in Wisconsin.

Wisconsin's PayNet Small Business Lending Index (SBLI) ranked 3rd nationally at 120.1, rising 0.1% from last month's state level to a value 22.3% greater than the national SBLI level this month (98.2). Year-over-year, business investment deteriorated 5.0%.

"Time will tell how these conditions will affect Wisconsin's economy going forward," says William Phelan, president of PayNet.

For more information on PayNet, visit www.paynet.com.

Source: PayNet