Wisconsin Small Business Defaults Down in May, Borrowing Up

Chicago, IL, July 25, 2017 (Newswire.com) - Fewer Wisconsin small businesses defaulted on existing loans and the level of borrowing activity improved in May 2017, data published by PayNet illustrate. The data suggest that financial conditions in the state may improve.

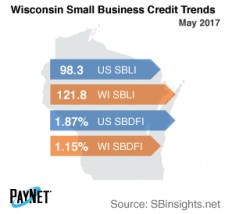

PayNet’s Small Business Default Index (SBDFI) for Wisconsin was second best in the country at only 1.15% following a 2 basis point improvement from April. Wisconsin's SBDFI was 72 basis points under the national SBDFI level of 1.87%. The national SBDFI increased 19 basis points year-over-year, whereas Wisconsin's SBDFI dipped 9 basis points.

The three industries with the highest default rate in Wisconsin were Transportation and Warehousing (3.34%); Mining, Quarrying, and Oil and Gas Extraction (2.07%); and Professional, Scientific, and Technical Services (1.93%). Nationally, Transportation and Warehousing had a default rate of 4.59%, with a difference of +0.99% compared to the prior year, while Wisconsin had a variance of -0.09%.

Registering at 121.8, the PayNet Small Business Lending Index (SBLI) for Wisconsin ranked 3rd nationally, rising 1.4% from last month's state level to a value 23.9% better than the national SBLI level of 98.3 this month. Small business borrowers are optimistically increasing investment.

"These conditions will positively affect Wisconsin's economy going forward," states the president of PayNet, William Phelan.

Source: www.paynet.com