What to Do if You Didn't Get Your First Child Tax Credit Payment

NEW YORK, August 3, 2021 (Newswire.com) - Part of the American Rescue Plan that President Joe Biden signed into law in March includes the expanded child tax credit, which is designed to reduce the rate of childhood poverty in the U.S.

The IRS sent out the first round of child tax credit payments for about 60 million children, totaling roughly $15 billion on July 15, but there have been reports from some parents that they didn't receive their checks at all, or their checks were for the wrong amount.

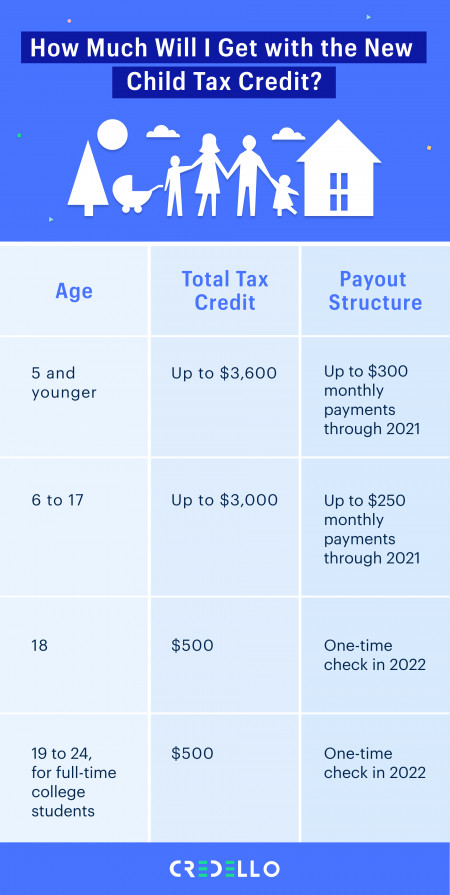

The child tax credit increased from up to $2,000 per child ages 16 and under to up to $3,600 per child under 6 and up to $3,000 per child ages 6-17. Unlike with the previous credit, which came as a lump sum when you filed your tax return, the new program allows you to receive monthly payments through the end of 2021. Parents also can opt out and continue to receive their payment as a lump sum.

Whether you're using these payments to put food on the table or help pay down debt, it's important to make sure you're getting the right amount as expected. If you didn't get your first child tax credit payment, there are a few steps you can take to make sure you get your next one, which goes out on Aug. 13.

Track your child tax credit payment

The best place to start is by using the IRS' Child Tax Credit Update Portal to track your payment, see if you're eligible/enrolled to receive payments, or update your bank account information.

If your status is pending eligibility, you won't receive your payment until the IRS is able to confirm your eligibility. Assuming the IRS is able to confirm your payment before the end of 2021, you should begin receiving monthly payments upon confirmation. But if the IRS can't confirm your eligibility before the end of the year, you'll likely receive the full credit when you file your 2021 taxes in early 2022.

Reasons why you might not have gotten your child tax credit or didn't get the right amount

There are several reasons why you might not have received your child tax credit or didn't get the amount you were expecting:

- No information or outdated information listed with the IRS (closed or inactive bank account)

- Misunderstanding of age breakdowns (e.g., to receive the $300 payment, a child needs to be younger than 6 as of Dec. 31, 2021. So, if your child turns 6 in November, you'll get $250 instead of $300. Similarly, 17-year-olds who turn 18 before Dec. 31, 2021 are ineligible for the advanced child tax credit.)

- Tax return is still being processed by the IRS

File your 2020 tax return or use the non-filer tool from the IRS

The IRS might not have your information if you haven't filed your taxes in 2020 or 2019 or aren't required to file your taxes. In that case, you can either file your taxes or use the IRS non-filer tool to start receiving your advance child tax credit payments.

If your income or tax situation has changed since filing your taxes (e.g., you birthed or adopted a child), you may need to update your information with the IRS.

Trace your child tax credit payment

As a last resort, if you've gone through the necessary steps to make sure you're eligible and your information is up-to-date, and you still haven't received your payment, you can request a payment trace to find the missing payment by completing Form 3911.

To file a payment trace, you have to wait:

- 5 days from the expected deposit date

- 4 weeks from the time the IRS sent a check to your address

- 6 weeks from the time the IRS sent a check to a forwarding address

- 9 weeks from the time the IRS sent a check to a foreign address

Source: Credello