What the New Child Tax Credit Could Mean for You Now and for Your 2021 Taxes

NEW YORK, July 19, 2021 (Newswire.com) - Whether you're behind on bills because of the pandemic and trying to pay off debt quickly with a low income or want to build up your emergency fund, the new advance Child Tax Credit could be a major boost for parents.

Here's what the new Child Tax Credit, which launched on July 15, 2021, could mean for you now and when filing your 2021 taxes next year.

Who qualifies for the Child Tax Credit?

If you—and your spouse, if you're married and filed jointly—filed your 2019 or 2020 tax return and claimed the Child Tax Credit, you qualify for the new advance Child Tax Credit.

If you haven't done that, you can still qualify if you meet the following criteria:

- You provided the IRS in 2020 with your information to receive the Economic Impact Payment using the "Non-Filers: Enter Payment Info Here" tool

- You have a main home in the U.S. (50 states or Washington, D.C.) for more than half the year, or your spouse who you file jointly with has a main home in the U.S. for more than half the year

- You have a qualifying child under the age of 18 by the end of 2021 who also has a valid Social Security number

- You made less than the income limit of $240,000 for single filers or heads of household and $440,000 for couples filing jointly.

What the new Child Tax Credit means for you in the immediate

Assuming you meet those qualifications, you're in line for some money in the form of advance monthly payments equal to half of the total credit amount, with the first one going out on July 15. You'll claim the other half when you file your 2021 income tax return (mark your calendar now for Tax Day on April 15, 2022). But note that this only applies to your 2021 taxes.

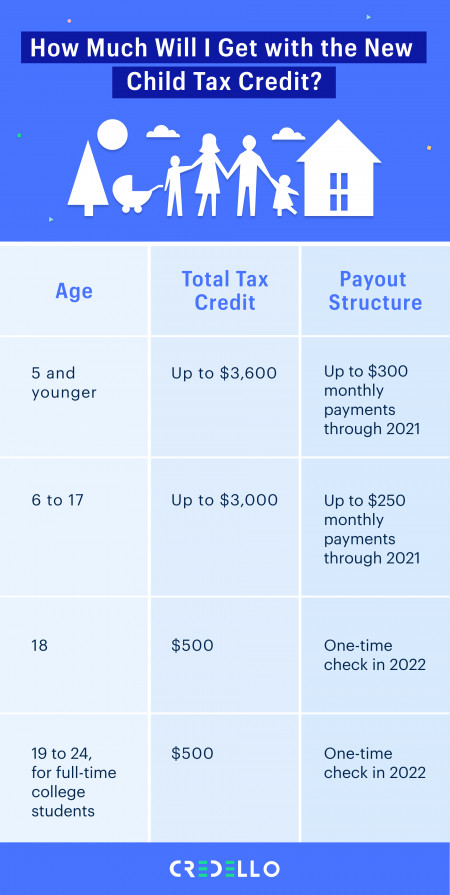

The amount you receive depends on the number of children you have, their ages, and your income. To qualify for the maximum amount, you need to have an adjusted gross income (AGI) of $75,000 or less as a single filer, $112,500 or less as head of household, or $150,000 as a couple filing jointly. Those making above those limits will see their tax credit phase out by $50 for every $1,000 they make above those levels until the $240,000 maximum for single filers/heads of household and $440,000 maximum for couple filing jointly.

How will the new Child Tax Credit affect your 2021 tax refund?

If you have concerns about whether you're eligible to receive the new advance Child Tax Credit, you may want to consult a professional. If it turns out you don't qualify but you receive the credit, you'll need to pay back the man when you file your 2021 taxes next year, which could ultimately set you back further.

The IRS also has an Advance Tax Child Credit Eligibility Assistant, which can help you navigate on your own whether you qualify.

While it's too late to opt out of the first advance Child Tax Credit, you can potentially opt out for future payments if you do it far enough in advance. For instance, you need to opt out of the Augus 15 payment by 11:59 p.m. on August 2, using the IRS' Child Tax Credit Update Portal.

Leave it to kids to make receiving *free money* from the government difficult.

Source: Credello