Washington Small Business Defaults on the Rise in April

Chicago, IL, June 14, 2017 (Newswire.com) - PayNet, the leading provider of credit ratings on small businesses, announces that in April 2017, the percentage of Washington's small businesses defaulting on existing loans has increased. Of the 18 major industries, defaults increased in 11 and dropped in 6 in the state compared to the prior month.

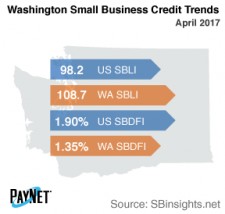

Despite a 4 basis point increase from March, Washington's PayNet Small Business Default Index (SBDFI) of 1.35% was still 55 basis points less than the national SBDFI level of 1.90%. The national SBDFI increased 26 basis points year-over-year, while Washington's SBDFI rose 5 basis points.

The industries with the worst default rate in Washington were Transportation and Warehousing (3.05%); Wholesale Trade (1.97%); and Information (1.91%). Nationally, Transportation and Warehousing had a default rate of 4.54%, with a difference of +1.12% compared to the prior year versus a variance of +0.66% in Washington.

Coming in at 108.7, the PayNet Small Business Lending Index (SBLI) for Washington rose 0.3% from the previous month's state level and was 10.7% greater than the national SBLI level this month. Small business borrowers are cautiously increasing investment.

"Time will tell how these conditions will affect Washington's economy going forward," says William Phelan, president of PayNet.

For more information on PayNet, visit www.paynet.com.

Source: PayNet