The Unbundling of Wealth Management: Zoe Financial's Stance

NEW YORK, October 28, 2019 (Newswire.com) - Zoe Financial released today a special report entitled The Unbundling of Wealth Management with insightful research inferring that the winning wealth management business model in the coming decade is the independent “fee-only” advisor model.

Be it “cutting” the cable cord by switching to Netflix or uploading a single in iTunes rather than purchasing a whole music album, technological innovation has reduced the benefits of bundled products and services for consumers. It appears that this trend is finally disrupting wealth management.

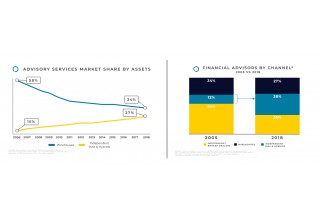

From tightly bundled products and services sold to consumers by Big Banks, known as “wirehouses,” during the mid-20th century to the unbundled offering of services provided by Independent Registered Investment Advisors (RIAs) today, the special report reviews the recent history and evolution of the wealth management industry. By conducting a thorough review of the unbundling, brought on by the emergence of new business models, Zoe’s evaluation then dove into which model offered the most benefits for the client.

Zoe analyzed 13,285 RIAs and found that practices that have an association with a broker-dealer have more client complaints and disciplinary actions compared to independent RIAs. In addition, advisors associated with broker-dealers appear to charge significantly higher fees than independent RIAs, despite offering similar services.

Zoe Financial’s report explains how the RIA business model emerged to compete against the incumbent full-service brokers and filled the desire felt by clients and advisors for more transparent modular services. The report also predicts the “Fee-only” RIA model will become the market leader as it provides the advisory service the consumers wants and needs with fewer conflicts of interest.

Find Zoe’s full report here: zoefin.com/unbundle.

For press inquiries, contact Natalie Jaeger at Natalie@ZoeFin.com.

Source: Zoe Financial