The Tablet Story Unfolds Among India SMBs - a Bitter Pill?

Bangalore, India, February 23, 2016 (Newswire.com) - According to AMI-Partners’ “2015-16 India SMB ICT & Cloud Services Tracker Overview”, tablets and tablet-related plans make up close to 8% of the total SMB mobility related expenditures. Mobile devices have already overtaken PCs in shipments. Due to this shift in device usage this gap is likely to widen substantially by 2019 as per AMI’s Global Market Forecast Model.

However, we can see some changes in the tablet space. Tablets which at one stage were thought to replace laptops and notebooks, have not really substituted that form factor. In fact, tablet shipments dipped in the last quarter of 2015 and several reasons maybe attributed to this dip. Rati Ghose, AVP-APAC, Market Insights at AMI-Partners, stated that “High-end smartphones have attracted the attention of users, tablets are not preferred for serious corporate work and the novelty value has worn off to some extent. In many cases we hear users opining that tablets are good to have as add-on devices rather than as full service devices for serious business.”

"High-end smartphones have attracted the attention of users, tablets are not preferred for serious corporate work and the novelty value has worn off to some extent. In many cases we hear users opining that tablets are good to have as add-on devices rather than as full service devices for serious business."

Rati Ghose, AVP-APAC, Market Insights at AMI-Partners

For medium businesses (MBs) tablet adoption has reached saturation, with businesses having at least one device per firm. Even so, there is still significant potential for additional new devices. Amongst small businesses (SBs), considerable potential yet exists for tablet adoption. Almost half of SBs are planning to deploy tablets in the near future. “But this is just penetration – when we speak of mass scale adoption, the potential is immense. The fillip for the adoption of tablets will come primarily from the increasing adoption of applications by India SMBs in order to enable and empower their mobile workforce as they expand their footprint to reach untapped and underserved markets in non-urban India,” added Ghose.

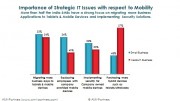

AMI’s “2015-16 India SMB ICT & Cloud Services Tracker Overview” study reveals that 55% of small businesses and 54% of medium businesses view migrating business applications such as online storage & document sharing, business analytics and CRM, to tablets and mobile devices to be a strategic priority. More than half of India SMBs are looking at the adoption of security solutions. “We find SMBs are looking to migrate discrete workloads from PCs to mobile devices. As SMBs purchase more hybrid devices such as tablets to deliver business applications or ensure seamless exchange of information, documents etc, it will involve implementing security solutions and backup solutions. This is expected to give rise to an entirely different set of needs,” mentioned Ghose. According to AMI’s latest findings, 52% of SBs and half of all MBs are focused on implementing security for company-owned mobile devices.

“One of the key mobility-related strategic issues for SMBs is to get their mobile workforce engaged to the business in a more cohesive manner. SMBs are gradually equipping employees with company-provided mobile devices and migrating more business applications to the cloud. Cloud based solutions such as ERP, CRM, social media and company-wide collaboration solutions are underway. However, this transition period has caused some uncertainties in the overall tablet market. Partners we meet hesitate to look at the crystal ball for tablet shipments within SMBs. They feel it is very volatile where some big deal may change the numbers significantly and become a game changer. Rather than viewing this as a bitter pill, they are optimistic in their outlook and recognize it is a volume game. They see immense potential in tablet uptake as and when these applications gain momentum. Tablet adoption amongst ground staff in verticals such as healthcare and microfinance has changed the way people engage and work on a day to day basis and SMBs will certainly reap the benefits from this increased reach,” stated Ghose.

There is growing acceptance of tablets in the price range of Rs 6000-8000 within the Indian market. “While brands such as Apple and Samsung hold sway, there is a need for low range tablets with less focus on warranty, servicing etc but that fulfill the basic mobility requirements – SMBs are open to sturdy and inexpensive ‘use and throw’ models which they can give their field staff without much worry. With the availability of a variety of models laden with features, brands such as Micromax, iBall and Datawind are doing well in upcountry areas. The need of the hour is to offer products that are affordable, sturdy and capable of delivering core business applications – and tie in to overall business strategies of expansion, growth and reach,” opines Ms. Ghose

Related Study

AMI’s recently published “2015-16 India SMB ICT & Cloud Services Tracker Overview” provides marketing and product executives the insights to effectively enhance/tweak their go-to-market approach within India SMBs for a greater bottom line impact. The study examines India SMBs’ business needs, including ICT priorities, purchase channel preferences and buying behavior at a granular level. The analysis also delves into numerous individual ICT categories (e.g. computing hardware & networking infrastructure, software, security, storage and internet/telecommunications) – both cloud and on-premise solutions. It further provides a clear sense of the overall market opportunity/outlook for each and the forces shaping that specific category. Shifts in the India SMB ICT landscape – including purchase channels – are highlighted and illustrate how vendors can best leverage those shifts to deliver solutions profitably.

For more information about this study, AMI, or our global SMB research, call 212 944 5100, e-mail ask_ami@ami-partners.com or visit www.ami-partners.com.

About Access Markets International (AMI) Partners, Inc.

AMI specializes in IT, Internet, telecommunications and business services strategy, venture capital, and actionable market intelligence — with a strong focus on global small and medium businesses (SMBs), and extending into large enterprises and home-based businesses. AMI-Partners’ mission is to empower clients for success with the highest quality data, business strategy perspectives and ―go-to-market solutions. Led by Andy Bose, the firm has built a world-class management team with deep experience cutting across IT, telecommunications and business services sectors in established and emerging markets.

AMI has helped shape the go-to-market SMB strategies of more than 150 leading IT, Internet, telecommunications and business services companies. The firm is well known for its IT and Internet adoption-based segmentation of the SMB markets; its annual retainership services based on global SMB tracking surveys in more than 25 countries; and its proprietary database of SMBs and SMB channel partners in the Americas, Europe and Asia-Pacific. The firm invests significantly in collecting survey based information from several thousand SMBs annually, and is considered the premier source for global SMB trends and analysis.

Media Contacts:

Quoted Analyst: Rati Ghose. Phone: (91) 80 4148 2661/62 ext 35. Email: rghose@ami-partners.com

Media Relations: In US (New York): Nancy Carty. Phone: (212) 944 5100 ext 581. Email: ncarty@ami-partners.com

In APAC (Singapore): Jackilyn Almazan. Phone: (65) 6521 3787 ext 115. Email: jalmazan@ami-partners.com

In India (Kolkata): Jyoti Singh. Phone: (91) 33 4003 3093 ext 223. Email: jsingh@ami-partners.com

In India (Bangalore): Sonam Prasad. Phone: (91) 80 4148 2661 ext 36. Email: sprasad@ami-partners.com

In India (Mumbai): Neha Jalan Goenka. Phone: (91) 98209 67614. Email: njalan@ami-partners.com