Space Fund Presents New Research on How the Space Industry is Uncorrelated to Other Investment Opportunities

LAS VEGAS, August 6, 2024 (Newswire.com) - At the AIAA ASCEND conference in Las Vegas, SpaceFund co-founder Meagan Crawford presented new research that shows the space industry is weakly correlated to eight tested market indices and alternative investment asset classes. This lack of correlation, coupled with the industry’s consistent growth, could offer valuable diversification and hedging opportunities for investors.

“As is often the case with new industries, space is not particularly well understood by the markets, or by the institutional investors that drive those markets,” said Meagan Crawford, co-founder of SpaceFund and primary author of the research study. “The purpose of this paper is to add to the growing body of research on space as an investment strategy, allowing institutional investors to consider space assets such as public stocks, private equity, and real estate as viable options for their portfolios.”

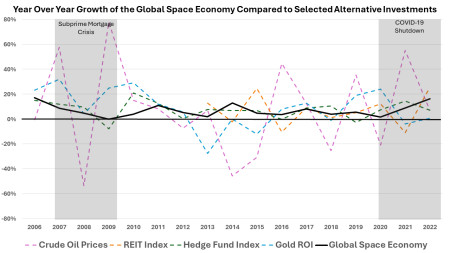

Correlation, or the measurement of how two data sets move in relation to each other, is frequently used by asset allocators to help protect their portfolios against Black Swan events and market downturns. However, until now, there has not been publicly available data on how space relates to other investment opportunities, making it very difficult for investors to assess the viability of space assets as a part of their portfolios. In this study, the space industry was compared to major market indices (S&P 1200, MSCI) and alternative investment asset classes (Global Oil Index, Crude Oil price per Barrel, REIT Index, Hedge Fund Index, Price of Bitcoin in USD, and Gold Return on Investment) and correlation was measured between two space industry data sets and each of these investment opportunities.

“As a former pension fund LP, this research study is exactly the type of content and academic support that is needed to get approvals for a new investment thesis,” said SpaceFund advisor and Former Trustee and Chair, Investment Committee at the US$20B SFERS, E. David Ellington. “The triumvirate of the institutions' board, staff, and consultants need this data to make intelligent investment decisions.”

The findings of this research suggest that space is weakly correlated to every investment sector tested, making space assets a viable consideration for institutional investors looking for opportunities to hedge against unforeseen risks. Additionally, the paper found that during the period tested (2005-2022), the space industry was the only tested sector that did not have a single year of negative growth, making space assets a viable consideration for institutional investors looking to diversify their portfolios into high-growth opportunities.

About SpaceFund

SpaceFund is a space venture capital firm, investing across the space startup ecosystem. The firm has raised two funds and made 21 investments across the space industry. More data and research about the space economy can be found at: https://spacefund.com

Source: SpaceFund