Small Business Defaults in Washington on the Rise in July

Chicago, IL, September 20, 2017 (Newswire.com) - PayNet, the premier provider of small business credit data and analysis for the commercial and industrial lending industry, announces that in July 2017 overall defaults increased among Washington's small businesses, with default rates in 10 of the 18 major industries rising in the state.

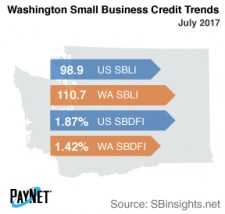

In spite of a 3 basis point rise from June, Washington's PayNet Small Business Default Index (SBDFI) at 1.42% was still 45 basis points under the national SBDFI level of 1.87%. Rising default rates over the past year signals heightened financial stress in the state. Over the last year, both the Washington and national SBDFI rose 15 basis points.

Transportation and Warehousing (2.81%); Accommodation and Food Services (2.69%); and Manufacturing (2.28%) recorded the worst default rates of all industries in Washington. Nationally, Transportation and Warehousing had a default rate of 4.57%, with a difference of +0.63% compared to the prior year, while Washington had a variance of +0.16%.

Coming in at 110.7, Washington's PayNet Small Business Lending Index (SBLI) improved 0.5% from the previous month's state level and was 11.9% greater than this month's national SBLI level (98.9). Small business borrowers are cautiously increasing investment.

"Higher defaults accompany more investment, leading to more GDP, more jobs, and more tax-paying," explains William Phelan, president of PayNet.

Source: www.paynet.com