Small Business Defaults in Texas Down in December

Dallas, TX, February 28, 2018 (Newswire.com) - In December 2017, fewer small businesses defaulted on loans in Texas, with default rates in 13 of the 18 major industries falling in the state, data issued by PayNet shows.

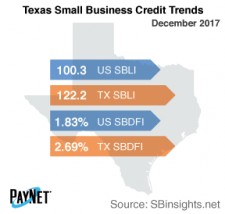

Despite an 11 basis point dip from November, Texas' PayNet Small Business Default Index (SBDFI) at 2.69% was the worst nationally and was still 86 basis points higher than the national SBDFI level of 1.83%. The decline in defaults over the past three months may signal improving financial health in the state. The national SBDFI has remained unchanged over the last year, whereas Texas' SBDFI dipped 56 basis points.

The three industries with the worst default rates in Texas were Transportation and Warehousing (5.16%); Mining, Quarrying, and Oil and Gas Extraction (4.55%); and Agriculture, Forestry, Fishing and Hunting (3.20%). Nationally, Transportation and Warehousing had a default rate of 4.00%, with a difference of --0.20% compared to the prior year, while Texas had a variance of -2.98%.

The PayNet Small Business Lending Index (SBLI) for Texas came in at 122.2, outperforming the national SBLI level (100.3) and performing similarly to the previous month's state level. Small business borrowers are considering increasing investment.

"Recent increased investment and improved financial health exhibited by Texas' small businesses set the stage for expansion with low credit risk," explains William Phelan, president of PayNet.

Source: PayNet