Small Business Defaults in Louisiana on the Decline in May

Chicago, IL, July 24, 2017 (Newswire.com) - PayNet, the leading provider of small business credit data and analysis for the commercial and industrial lending industry, reports that in May 2017 fewer of Louisiana's small businesses defaulted on existing loans. Of the 18 major industries, defaults improved in 14 and worsened in 4 in the state compared to the previous month.

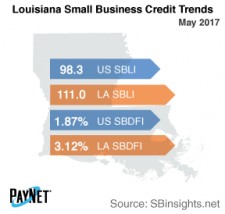

Despite a 12 basis point drop from April, Louisiana's PayNet Small Business Default Index (SBDFI) at 3.12% was one of the worst in the country and was 125 basis points above the national SBDFI level of 1.87%. Financial health is weaker than a year ago in the state despite the recent downturn in defaults. Louisiana's SBDFI increased 55 basis points over the last year, while the national SBDFI rose 19 basis points.

The three industries with the worst default rate in Louisiana were Transportation and Warehousing (7.13%); Mining, Quarrying, and Oil and Gas Extraction (6.99%); and Agriculture, Forestry, Fishing and Hunting (5.16%). Nationally, Transportation and Warehousing had a default rate of 4.59%, with a difference of +0.99% compared to the prior year, while Louisiana had a variance of +2.00%.

Registering at 111.0, Louisiana's PayNet Small Business Lending Index (SBLI) surpassed the national SBLI level (98.3) despite dropping by 0.4% from last month's state level.

"More definitive trends are needed to gauge the future economic performance for Louisiana," explains the president of PayNet, William Phelan.

Source: www.paynet.com