Small Business Borrowing in Georgia Stalls in July

Chicago, IL, September 20, 2017 (Newswire.com) - In July 2017, borrowing remained stagnant in Georgia, data released by PayNet indicates. Of the 18 major industries, 9 decreased and 9 rose in Georgia.

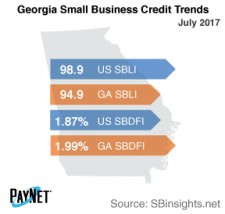

The PayNet Small Business Lending Index (SBLI) for Georgia registered at 94.9, performing comparably to last month's state level, but 4.0% below this month's national SBLI level (98.9).

The three industries with the greatest decline in lending activity over the past year in Georgia were Real Estate and Rental and Leasing (-13.4%); Health Care and Social Assistance (-10.5%); and Mining, Quarrying, and Oil and Gas Extraction (-7.8%). Nationally, Real Estate and Rental and Leasing fell by -2.4% year over year.

After maintaining a comparable value to the previous month, Georgia's PayNet Small Business Default Index (SBDFI) of 1.99% was 12 basis points greater than the national SBDFI level of 1.87%. Compared to last year, the national SBDFI climbed 15 basis points, whereas Georgia's SBDFI dipped 5 basis points.

"More definitive trends are needed to gauge the future economic performance for Georgia," explains the president of PayNet, William Phelan.

Source: www.paynet.com