Small Business Borrowing in Florida on the Decline in September

Jacksonville, FL, November 21, 2017 (Newswire.com) - PayNet, the premier provider of small business credit assessments on private companies, announces that in September 2017 Florida's small firm borrowing activity decreased, with 16 of the 18 major industries falling in the state.

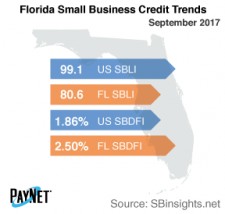

Florida's PayNet Small Business Lending Index (SBLI) came in at 80.6, falling 1.2% from last month's state level and 18.7% below the national SBLI level of 99.1 this month.

More definitive trends are needed to gauge the future economic performance for Florida.

William Phelan, President

The three industries with the most unfavorable change in lending activity over the past year in Florida were Transportation and Warehousing (-14.5%); Finance and Insurance (-13.2%); and Health Care and Social Assistance (-9.6%). Nationally, Transportation and Warehousing fell by -5.7% year over year.

PayNet’s Small Business Default Index (SBDFI) for Florida ranked 48th in the country at 2.50%. After a similar performance to the previous month, Florida's SBDFI was 64 basis points above the national SBDFI level of 1.86%. Over the last year, Florida's SBDFI climbed 21 basis points, which was a much higher upturn than the 7 basis point increase exhibited by the national SBDFI.

"More definitive trends are needed to gauge the future economic performance for Florida," explains the president of PayNet, William Phelan.

Source: www.paynet.com