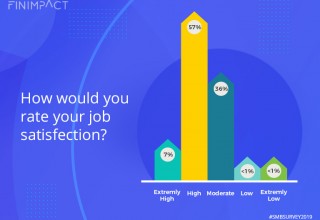

New Study Unveils US Small Business Owners Reporting High Levels of Job Satisfaction

NEW YORK, August 14, 2019 (Newswire.com) - In general, U.S. business owners tend to be very happy, according to a survey carried out by Finimpact.com.

While owning a business is commonly cited as stressful and incredibly time-consuming, small business owners still report higher levels of job satisfaction than many other categories. The survey also unveiled a number of key trends and patterns among U.S. small business owners.

Why So Satisfied?

There are still many barriers to opening a small business in the USA. Thirty-five percent of respondents indicated that financial access was a dominant concern. Lack of talent, as well as government regulation, were also reported as issues.

But despite these concerns, most business owners feel they have enough time and energy, think their industry is easy to make profits in and would recommend other people starting out to follow their paths. The outlook is positive and despite the hurdles, U.S. business owners remain optimistic.

This is most likely because entrepreneurs and small business owners tend to prefer risk and freedom, as opposed to stability and safety, reflecting their dominant personality traits. So the challenges and volatility actually suit their disposition.

The high levels of job satisfaction are continually reported among this group of persons across various time horizons and economic challenges.

Other Findings

The survey unveiled a number of key findings that are important to take note of. These include:

- Long-term employees are preferred to contractors.

- Local U.S. hires are preferred to minorities and immigrants.

- Freedom is the most important reason for starting a business, beating money, prestige, and even job satisfaction.

- Sales and customer service are the two areas delivering the biggest return on investment.

- Thirty-five percent of small business owners believe that educational qualifications are essentially pointless in terms of running a commercial enterprise.

- Over half of the survey respondents indicated that getting a loan was either hard or very hard, with only 7% reporting that getting a loan was easy.

- Over half of respondents indicated that they hit their financial targets sooner than expected.

For the full results of this study, visit - https://www.finimpact.com/smb-survey-2019/

About Finimpact

Finimpact.com is a financial services provider that seeks to empower small businesses through a variety of different methods, primarily access to capital.

This is because businesses typically either cannot gain access to capital, gain access to the wrong kind of capital or mismanage their cash flow. Finimpact helps to connect small business owners with the right capital through online lending resources.

Contact: info@finimpact.com

Source: Finimpact