New Mexico Small Business Defaults Up in September, as is Borrowing

Santa Fe, New Mexico, November 21, 2017 (Newswire.com) - Data released by PayNet illustrate that the percentage of New Mexico's small businesses defaulting on loans has increased and the level of borrowing activity improved in September 2017. The data suggest that financial conditions in the state may weaken.

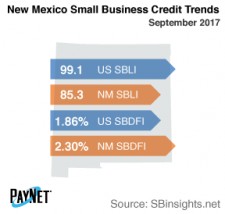

After a 5 basis point rise from August, New Mexico's PayNet Small Business Default Index (SBDFI) at 2.30% was 44 basis points greater than the national SBDFI level of 1.86%. New Mexico's SBDFI increased 11 basis points year-over-year, while the national SBDFI increased 7 basis points.

The three industries with the highest default rates in New Mexico were Mining, Quarrying, and Oil and Gas Extraction (5.66%); Transportation and Warehousing (4.93%); and Construction (2.71%). Nationally, Mining, Quarrying, and Oil and Gas Extraction had a default rate of 3.05%, with a difference of --1.37% compared to the prior year, while New Mexico had a variance of +0.32%.

New Mexico's PayNet Small Business Lending Index (SBLI) registered at 85.3, up 1.8% from the previous month's state level, but 13.9% below the national SBLI level of 99.1 this month.

"Time will tell how these conditions will affect New Mexico's economy going forward," states William Phelan, president of PayNet.

Source: www.paynet.com