New Jersey Small Business Defaults on the Decline in July

Chicago, IL, September 20, 2017 (Newswire.com) - PayNet, the premier provider of small business credit assessments on private companies, reports that in July 2017 overall defaults improved among small businesses in New Jersey. Of the 18 major industries, defaults declined in 13 and increased in 5 in the state compared to the previous month.

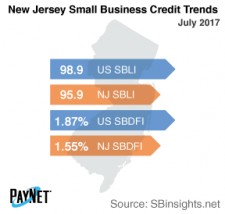

The PayNet Small Business Default Index (SBDFI) for New Jersey registered at 1.55% after a 4 basis point improvement from June. Compared to the national SBDFI level of 1.87%, New Jersey's SBDFI was 32 basis points lower. Year-over-year, the national SBDFI increased 15 basis points, whereas New Jersey's SBDFI declined 7 basis points.

The industries with the highest default rates in New Jersey were Transportation and Warehousing (3.30%); Accommodation and Food Services (2.34%); and Construction (2.04%). Nationally, Transportation and Warehousing had a default rate of 4.57%, with a difference of +0.63% compared to the prior year, while New Jersey had a variance of +0.08%.

The PayNet Small Business Lending Index (SBLI) for New Jersey was 95.9, improving 0.2% from the previous month's state level, but 3.0% lower than the national SBLI level of 98.9 this month. Year-over-year, business investment deteriorated 3.0%.

"Time will tell how these conditions will affect New Jersey's economy going forward," asserts William Phelan, president of PayNet.

Source: www.paynet.com