Ludicrous Returns LLC Develops New Technical Analysis Method for Investing in Stocks or S&P500 Index

WASHINGTON, MI, November 21, 2023 (Newswire.com) - Ludicrous Returns LLC releases the launch of a new stock investment model training video at ludicrousreturns.com. “In 2016, I had an epiphany. I wondered if there was a relationship between stock pattern attributes and future 3- to 6-month performance” – Joe Furnari, Founder of Ludicrous Returns. Data analysis was conducted on hundreds of stocks from 1970 – 2020 on a mission to find patterns that predict. Several patterns that predict with high correlation were discovered. These patterns consistently predicted over the 50 year period of studying charts, across stocks of many industries and market caps. These patterns were developed into the stock model, configured to buy and hold stocks during periods of solid growth potential and sell when predicted pattern is trend horizontal or decline. To prove model concept, a model simulation post mortem test was conducted from 2007 to 2020.

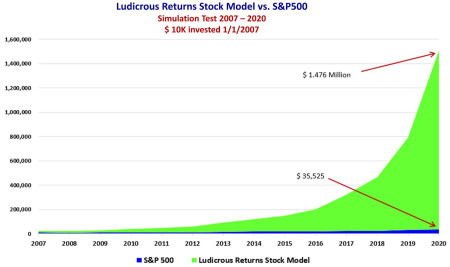

14-year Stock Model Test results:

- Of 500-750 stock screened each year, model selected only 15% to buy

- 2007 – 2020 Average Annual Return was 44.5% (In back simulation test, model grew a $ 10K investment to $ 1.476 million)

- Model capital gain to loss ratio is 24:1

All results, including stocks rejected, selected, buy & sell dates and prices are now available for download on ludicrousreturns.com. The Ludicrous stock model is not a day trading system. The system involves charting stocks once per week and some selected stocks daily after market close.

Stock model was developed to:

- Screen for the stocks

- Identify when to buy or sell based on patterns that predict

A new video training class on how to use the Ludicrous Stock Model is now available on at ludicrousreturns.com.

A second model, called the market timing model was developed using patterns that predict. This model optimizes position between S&P500 equity index and cash. The market timing model was developed with a vision to beat performance of the buy and hold investment strategy over the long-term. In a simulation test 1970 - 2021, the market timing model grew wealth 4.8x buy and hold. The model works by selling equities before a potential crash, and then buying back in at a good time.

A video training class on how to apply the Ludicrous Market Timing Model has just been launched on ludicrousreturns.com. Class includes exact model logic applied to all trades within the 52-year simulation test.

About the Model Developer: Joe Furnari is an experienced investor with an MBA in Finance and has authored the book, “Ludicrous Returns vs. The Market”. Joe has a background in Engineering and is passionate about applying data science and analysis. He has developed two groundbreaking investment models based on using technical analysis to enhance investment performance, one model for managing investments in stocks and another to manage investments in equity index.

Source: Ludicrous Returns LLC