Insurance Risk Services of Georgia finds roadside assistance towing programs lack financial responsibility, accountability and expose motorists to great financial risks

ATLANTA, February 22, 2022 (Newswire.com) - Insurance Risk Services of Georgia (IRSG) finds roadside assistance towing programs lack financial responsibility, accountability and expose motorists to great financial risk with using roadside assistance towing services, according to a recent insurance risk assessment of Georgia's towing industry.

In a Risk Assessment for Georgia's Towing Industry, IRSG found that roadside assistance programs, third-party roadside assistance dispatch companies that profit off dispatching towing services for automotive manufacturers and insurance carriers, dispatch tow services to motorists in need while operating without financial responsibility and accountability to the motorist. IRSG has found that roadside assistance dispatch companies use tow providers that lack training, improper equipment and fail to meet minimum legal requirements to operate. Roadside assistance dispatch companies pay low rates that fail to cover labor and operational costs for the service, often resulting in damages to a vehicle. When damage incidents occur, the roadside assistance dispatch companies hide behind complicated vendor contracts that shield them from liability, leaving the motorist to deal with the problem on their own. When a commercial transportation insurance claim occurs, the claim process takes an average of three months to process, and then is usually denied or settled at a fraction of the claim amount. Commercial insurance programs operate much differently from consumer insurance.

With new vehicles having traction control systems, carbon fiber, aluminum frames and other expensive computer technology, motorists have no idea about which towing companies to use, so they depend on the roadside assistance towing programs to help get vehicles safely to a dealership or repair facility. However, roadside assistance towing programs are the worst to use because they are looking to make a profit and fail to pay rates that cover training for new technology, to possess proper equipment and to meet legal standards, exposing the motorist to great financial risks.

When a motorist calls for roadside assistance, they are often deceived into believing they are speaking to the actual vehicle manufacturer or insurance carrier, but actually are speaking with a third-party roadside assistance call center. These operators have no idea of the situation, equipment needs, costs and legal issues. It's common for misleading/false information to be relayed to the motorist about services and costs. It is not uncommon for a motorists to have an outstanding bill at the end of service because equipment and additional labor or services are not covered in the motorist roadside towing program. Roadside dispatch companies use tow providers who accept the lowest rates (around $35) that will not cover labor, equipment, training, and legal other legal requirements. To make matters worse, roadside assistance dispatch companies are notorious for making partial-payment or no payment for services rendered by the tow provider. When this happens, it's not uncommon for a mechanic's lien to be filed with the state against the vehicle receiving services because that is the collection avenue provided by law.

To help shield the roadside assistance companies from liability exposure, most roadside assistance programs have discontinued direct telephone communication with tow providers and motorists with the use of a smartphone app or internet software, providing a huge disconnection with the communication process. The telephone hold time to speak to a roadside assistance operator averages about 86 minutes, without any compensation for the telephone-wait-time labor being paid to the tow provider. When a damage incident takes place, roadside companies use this to hide behind complicated vendor contracts while telling the motorist to file a claim with their insurance company.

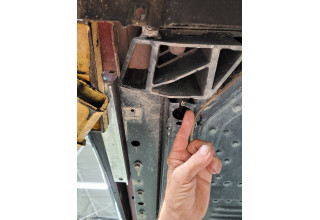

With today's culture moving to electric vehicles, the roadside assistance dispatching companies are not providing additional funding for tow providers to get training to keep up with the new technology. This technology requires tow providers to be educated, trained and made aware of the legal issues with these vehicles. A roadside assistance company recently had an incident where they sent out a tow provider to pick up a 2022 Ford Mach-E, which was disabled on the side of the road. The roadside assistance dispatched a tow provider who arrived at the scene with a truck that failed to meet federally mandated weight limits. Then the operator improperly hooked the winch-cable to the battery-frame-rail and pulled the vehicle with the cable attached to the wrong connection point, resulting in damages to the EV battery-rail totaling $28,000. The owner of the EV has spoken to the roadside assistance dispatch company, the insurance company of the tow provider and his insurance carrier only to find out there is no insurance coverages for this incident, leaving him with a $28,000 repair bill[x1].

Commercial Insurance Carriers are tired of paying claims made by towers who fail to have proper training, proper equipment, and financial responsibility. Therefore, they are requiring tow providers to get addendums to the on-hook-cargo portion of the policy to cover high-end luxury, specialty and electric vehicles. Tow providers must qualify with risk assessments and underwriting guidelines with an insurance carrier prior to these coverages being issued. Insurance agents and underwriters have also started placing policy restrictions on towing companies from conducting business with some roadside assistance companies due to the unethical, illegal business practices and financial risks they bring. Many roadside assistance programs and tow providers ignore these required provisions.

Most roadside assistance programs do not cover the additional costs associated with luxury, specialty or electrical vehicles (EV). They pay low fees for all vehicles. EV technology is expensive and so is the equipment and insurance required. The national average ten-mile tow bill for an EV averages about $365. In the Atlanta seven-county metro area, there are only four tow companies that possess the training, equipment and insurance required to tow EVs. Most roadside assistance tow providers fail to use proper equipment that meets federal requirements. EVs are heavy (average of 6,000 lbs.) and require special equipment (26,000 lbs. truck is required). Ford F550 and Dodge 5500 roll-backs and wheel-lifts cannot legally tow an EV because EVs exceed the federal weight capacity limits with these trucks, therefore there is no insurance coverage when a damage claim occurs. EVs do not go into neutral and have no attachment points for a winch cable. Tie-down straps used on regular vehicles are too weak to hold EVs.

European Union countries have solved their EV towing issues by making mandates for the EasTract Towing Robot to be used by law enforcement and emergency roadside assistance when dealing with EVs and disabled AWD vehicles. Mercedes, BMW, Jaguar, Land Rover, Porsche, and Tesla have been using the EasTract technology for years. The EasTract-TowTract Robot is manufactured and imported from Italy. It physically carries a vehicle out of tight, confined areas by picking the vehicle up by all four wheels without the need of keys or vehicle entry. It makes towing procedures obsolete because it uses a propriety-robotic system to load and transport the vehicle. The EasTract-TowTract machines can lift an 8,500-lb. vehicle and tow it to the location where the vehicle can be surgically placed inside a mechanics bay or wherever, completing tasks that no other machine or person can do. According to EasTract North America, the EasTract-TowTract has completed over 25,000 vehicle moves in North America without any damage claim being made. There are over 160 machines in use throughout North America and over 1,500 machines worldwide.

With the ongoing financial risk exposure to the motorist with roadside assistance tow programs, major changes need to be made to prevent the continuation of damage incidents. The European automotive operations have solved the plethora of issues experienced with EVs and AWD vehicles with the EasTract technology. It appears to be the only solution around capable of solving all the technical issues. The EU has mandated its use when towing EVs. Vehicle manufacturers, insurance carriers and roadside assistance dispatch companies to make changes to ensure tow providers are paid rates that cover the costs of equipment, training and other legal requirements. Until that time, motorist need to forget about using roadside assistance towing programs to avoid a costly situations like the Mach-E, and research towing companies in their area and find a reputable tow company that meets the motorist's needs.

Jason Peacock, jpeacock@insuranceriskservicesga.com

Insurance Risk Services of Georgia,

Source: Insurance Risk Services of Georgia (IRSG)