Infinity Galaxy Expert Analysis: Four Major Key Drivers of Bitumen Price

DUBAI, Arab Emirates, September 8, 2022 (Newswire.com) - The bitumen price went through ups and downs in the last 100 weeks from September 2020 until August 2022. The minimum price was 220 USD/MT and the maximum price soared to 505 USD/MT.

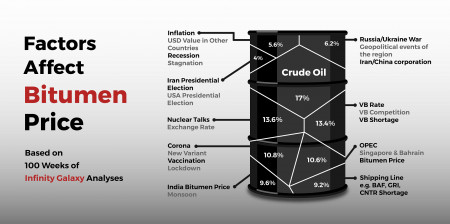

Infinity Galaxy, an international bitumen supplier and market analyst, has statistically analyzed the influential factors on bitumen price during the last 100 weeks.

During the period, the bitumen market came across arduous volatility. Some of the market's influencing factors include:

- Crude Oil Fluctuation and OPEC+ Decisions (27%)

- Vacuum Bottom (13%)

- Covid 19 (10%)

- Shipping Rates (10%)

Other factors during 2020-2022 were JCPOA, Russia-Ukraine war, inflation and recession, Monsoon and both USA and Iran presidential election.

Crude Oil Fluctuations and OPEC+ Decisions

Oil price fluctuations and some OPEC+ decisions were the most influential factors on the bitumen price.

One of the major increases in bitumen price in the last 100 weeks occurred in November 2020, following the US presidential election and the announcement of the vaccine discovery by Pfizer. The crude price soared by about $10 compared to October 2020 and the bitumen price rose from 230 USD/MT to 290 USD/MT.

IEA reported, "Crude oil prices hit a seven-year high in early October 2021 boosted by energy supply concerns and continued oil stock draws". Accordingly, bitumen price increased by around $70.

Crude oil prices fell by $15 over November by growing concerns over Covid-19, inflation and economic growth. Bitumen prices, following crude, decreased by $35.

In February 2022, due to the Russia-Ukraine war, oil price soared above $100 leading to bitumen price above 500 USD/MT.

As reported by McKinsey, from June to July 2022, oil price decreased from $123 to $112 due to high inflation and high-interest rates. Interestingly, the price decreased by $90 after the oil plunge.

Vacuum Bottom

Due to the bitumen feedstock shortage caused by a lack of manpower, high demand, and fierce competition for feedstock, the vacuum bottom price increased by more than 40%. The increase pulled bitumen prices even higher.

Covid 19

Local Covid lockdowns played havoc with constructions. Many road construction projects stopped, especially in Asian countries.

The low demand for bitumen during covid19 peaks caused a downward trend in bitumen markets.

Shipping Rates

During the last 100 weeks, freight fluctuations directly affected bitumen markets. In this period, container fares tripled.

New GRI, BAF, and port congestion caused container prices to increase by 150% to 450% which resulted in bitumen price growth.

Infinity Galaxy has already analyzed the increase in shipping rates and its effect on the bitumen price which one can read here.

Visit https://infinitygalaxy.org to read weekly bitumen market reports or contact Infinity Galaxy's team via info@infinitygalaxy.org.

Source: Infinity Galaxy