Florida Small Business Defaults Up in February

Chicago, IL, April 13, 2017 (Newswire.com) - In February 2017, small business loan defaults increased in Florida's business community, data released by PayNet show. Of the 18 major industries, 9 worsened and 8 improved in the state.

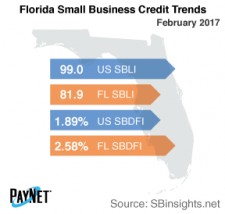

The PayNet Small Business Default Index (SBDFI) for Florida registered at 2.58% following a 9 basis point rise from January. Florida's SBDFI was 69 basis points higher than the national SBDFI level of 1.89%. Rising default rates over the past year signal heightened financial stress in the state. Over the last year, Florida's SBDFI increased 75 basis points, which was a significantly steeper rise than the 30 basis point increase displayed by the national SBDFI.

Transportation and Warehousing (6.11%); Professional, Scientific, and Technical Services (3.73%); and Finance and Insurance (3.02%) recorded the worst default rates of all industries in Florida. Nationally, Transportation and Warehousing had a default rate of 4.44%, with a difference of +1.31% compared to the prior year variance of +0.90% in Florida.

Florida's PayNet Small Business Lending Index (SBLI) came in at 81.9, down 0.8% from the previous month's state level, but 17.3% lower than the national SBLI level this month. Small business borrowers are being cautious and holding off on new investment.

"The increasing default rate over the past year has created a cautious lending environment," states the president of PayNet, William Phelan.

Source: PayNet