Florida Small Business Defaults Fall in November

Chicago, IL, January 24, 2018 (Newswire.com) - In November 2017, small business loan defaults decreased in Florida's business community, with default rates in 13 of the 18 major industries falling in the state, according to data released by PayNet.

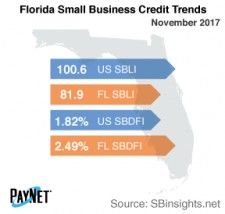

In spite of a 3 basis point decrease from October, Florida's PayNet Small Business Default Index (SBDFI) at 2.49% was one of the worst in the country and was still 67 basis points above the national SBDFI level of 1.82%. Financial health is weaker than a year ago in the state despite the recent downturn in defaults. Florida's SBDFI increased 9 basis points year-over-year, whereas the national SBDFI declined 1 basis point.

The industries with the worst default rates in Florida were Transportation and Warehousing (5.46%); Information (4.87%); and Health Care and Social Assistance (3.63%). Nationally, Transportation and Warehousing had a default rate of 4.14%, with a difference of -0.08% compared to the prior year, while Florida had a variance of -1.17%.

The PayNet Small Business Lending Index (SBLI) for Florida registered at 81.9, progressing 0.1% from the previous month's state level, but 18.6% lower than this month's national SBLI level (100.6).

" Time will tell how these conditions will affect Florida’s economy going forward," states William Phelan, president of PayNet.

Source: PayNet