EzPaycheck 2015 Payroll Software Adds New Feature to Simplify Form 941 Filing

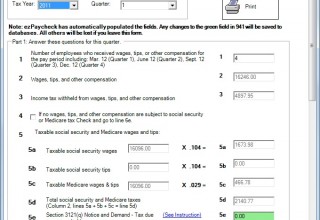

Houston, TX, May 20, 2015 (Newswire.com) - EzPaycheck payroll software is the easy-to-use application from Halfpricesoft.com that caters to to small and mid size business owners new to payroll processing. Developer’s at Halfpricesoft.com have just improved ezPaycheck 2015 payroll software to include a new 941 deposit report feature in response to customers’ requests.

“EzPaycheck software speeds up payroll processing for small businesses. We now add this new 941 report to help customers deposit federal income taxes easily. ” explains Dr. Ge, President and Founder of halfpricesoft.com

EzPaycheck software speeds up payroll processing for small businesses. We now add this new 941 report to help customers deposit federal income taxes easily

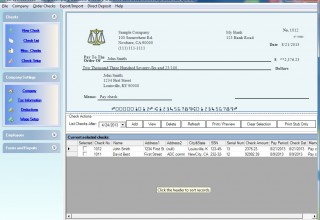

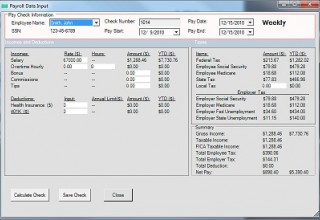

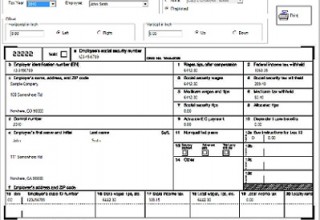

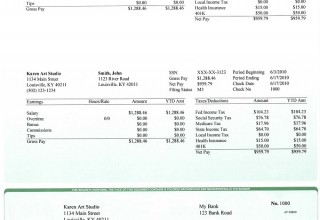

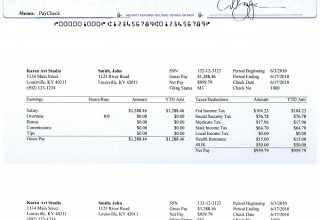

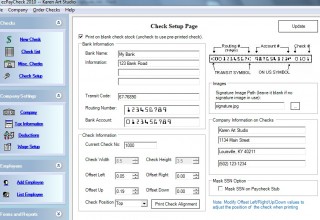

Engineered for small business customers, ezPaycheck’s grahic interface is straighforward and easy to easy. The easy to use and inexpensive graphical interface allows customers to calculate payroll taxes, print paychecks as well as W2, W3, 940, 941 forms all within one software application.

Customers seeking a way to simplify payroll processing with more accuracy can go online to http://www.halfpricesoft.com/payroll_software_download.asp and download the payroll accounting software. The download includes the full version of the paycheck software along with a sample database. The sample database allows new customers to try all of ezPaycheck’s exciting features, including the intuitive graphical interface, without wasting time entering data.

The main features include:

- Offers no cost live chat, email and remote access for customer support for software product

- Supports differential pay rates within the company

- Supports daily, weekly, biweekly, semimonthly and monthly pay periods

- Features report functions, print functions, and pay stub functions

- Supports both miscellaneous checks and payroll calculation checks

- Supports both blank computer checks or preprinted checks

- Automatically calculates Federal Withholding Tax, Social Security, Medicare Tax and Employer Unemployment Taxes

- Includes built-in tax tables for all 50 states and the District of Columbia

- Creates and maintains payroll for multiple companies, and does it simultaneously

- Prints Tax Forms 940, 941, W-2 and W-3

- Supports unlimited accounts at no additional charge

- Supports network for multiple users

Accountants are welcome to test drive ezPaycheck payroll software at http://www.halfpricesoft.com/index.asp

About Halfpricesoft.com

Halfpricesoft.com is a leading provider of small business software, including payroll software, employee attendance tracking software, accounting software, check printing software, W2, software, 1099 software, and ezACH direct deposit software. Software from halfpricesoft.com is trusted by thousands of customers and will help small business owners simplify their payroll processing and business management.