Educational Money App Treasure Card Launches to Teach Kids Smart Habits Around Spending, Saving and Donating With Money From the Bank of Mom and Dad

TORONTO, October 14, 2020 (Newswire.com) - Kids are like sponges when it comes to new concepts, making this the perfect time to teach financial literacy. Research shows that the younger you teach children about money, the more independent and responsible they will be as adults. This is why Treasure exists. Treasure, a mobile money management app has been built to teach kids the value of money, fun ways to earn and save their allowance and money received through gifts.

“Financial literacy is a key life skill, but schools don’t teach finance-related courses properly until middle school or high school, and I think that is not only crazy but also way too late to form good habits,” said Matt O’Leary, CEO of Treasure. “Kids need money skills as soon as they can count. My own kids would ask for things in the store without realizing the cost or need to take money to school as early as kindergarten, and that’s when I realized that kids need money skills as soon as they can count.”

Treasure is a fun-first education tool that teaches positive financial habits around saving and spending, but unlike other tools, Treasure uses real money with real spending and saving options using the bank of Mom and Dad through allowance and task-driven incentives.

“We all know someone who got in trouble when they got their first credit card. This is because a credit card isn't money. It's just an abstract concept,” says O’Leary. “Our research has shown that the reason it is important to start teaching kids about money as early as possible is based on the fact that many financial decisions are based on abstract logic and reasoning similar to the credit card example I gave. What it means is that something as simple as using a credit card relies on the idea of what a credit card represents. Before you can hand someone a credit card they need to understand the value of money and how to save and spend it responsibly, and Treasure is the foundation of that education process.”

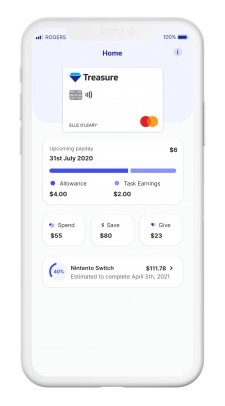

How Treasure works is simple. Parents pay kids a fixed allowance or allow them to earn via tasks. Those culminate in a weekly payday, where kids must save some money and decide how much of the remainder to put towards their goals, giving fund, etc. Parents and kids each get their own app to track tasks, balances, all while learning the real value of money and the concepts around its power.

Treasure is currently available for download in the iTunes store and Google Play store throughout North America, with a spendable debit card being added in early 2021.

For more information on Treasure Card, go to www.treasurecard.com

Media Contact:

Saul Colt

416-219-3259

saulcolt@theideaintegration.com

Source: Treasure Card