Cerrado Gold Announces Q3 Gold Production Results For Its Minera Don Nicolas Mine In Argentina

Q3 Production of 16,604 Gold Equivalent Ounces ("GEO") vs 16,255 GEO in Q2 and 11,204 in Q1, 2024.

Calandrias Norte high-grade ore supplemented by additional pits extending CIL operation into 2025.

Production of 3,404, GEO from Heap leach operations during the quarter with a record of 1,644 GEO in August.

Balance sheet continues to improve, with approximately US$12m in current liabilities repaid since March 2024.

Online, October 16, 2024 (Newswire.com) - Cerrado Gold Inc. [TSX.V:CERT][OTCQX:CRDOF] ("Cerrado" or the "Company") announces production results for the third quarter ended September, 2024 ("Q3 2024") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full third quarter financial results are expected to be released in November 2024.

Q3 Operating Highlights

Q3 Production of 16,604 GEO vs 16,255 GEO in Q2 and 11,204 in Q1, 2024.

Choique and Zorro pits supplemented CIL feed from Calandrias Norte during the quarter. CIL plant will continue operating until the end of January 2025.

Focus remains on doubling up crushing capacity at Calandrias Sur and bringing heap leach production up to 4,500 GEO per month.

Operational results for Q3 2024 demonstrated a slight increase in production over the the previous quarter, highlighting stabilized operations. Ore from the Calandrias Norte high-grade open pit was exhausted but replaced by additional high-grade feed from two additional pits. In addition, the ramp up of heap leach operations continued to improve as crushing capacity continued to climb with record production of 1,644 GEO in August before a slight decline in September as some adjustments were put in place to support the overall expansion of the facilities. The performance of the Heap leach continues to depend on the crushing circuit. To maintain production rates until an additional crushing circuit is installed, two mobile crushers were added, resulting in a total crushing capacity of 300,000 tons per month. The design of a new crushing circuit is complete, and a secondary crusher has been ordered. The secondary crusher will double the capacity with a single crushing circuit supporting the ramp up in production from the heap leach operations. The installation of the secondary crusher is expected to reduce fleet and operating costs. The new circuit is expected to operate by the end of the 4th quarter, at which time the mobile crushers will be placed on stand by. Recovery rates are in line with expectations given ore on the pad to date.

The Company has also continued to make progress in improving its working capital position during the quarter, partly due to the cashflow generated by high gold prices and strong production. At quarter end, the Company's total current liabilities (including payables, loans, and amounts due to the Sellers) have been reduced by approximately US$12MM from the end of Q1 2024, with further reductions expected in the coming quarters, strengthening the overall financial position of the Company.

Mark Brennan, CEO and Chairman commented, "Production in the third quarter remained strong over the second quarter owing to additional high-grade feed to the CIL as well as increasing production from the heap leach facility. As crushing performance continues to improve, we expect to see heap leach production continue its upward trajectory towards the targeted 4,500 GEO per month with a commiserate reduction in operating costs."

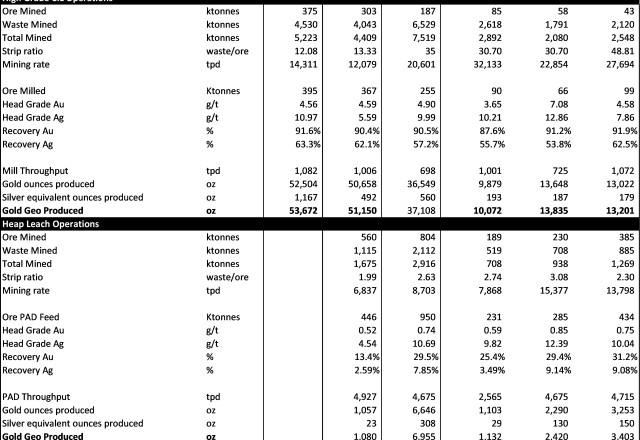

Table 1. Key Operating Information

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina, and the highly prospective Monte Do Carmo development project, located in Tocantins State, Brazil under option to Amarillo Mineração Do Brasil Ltda., a subsidiary of Hochschild Mining PLC. In Canada, Cerrado Gold is developing it's 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, the potential for additional crushing capacity that may be added, the performance of the heap leach pad, CIL plant life extension, anticipated production in Q4 2024 and anticipated strengthening of the Company's financial position. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

Source: Cerrado Gold Inc.