Author Joe Furnari Releases New Book 'Ludicrous Returns vs. the Market'

WASHINGTON, Mich., November 3, 2023 (Newswire.com) - Gatekeeper Press is pleased to announce “Ludicrous Returns vs. the Market” launch in November 2023. This book introduces a new groundbreaking approach for investing. Author Joe Furnari is an experienced investor with an MBA in Finance and also an Engineer with a passion for data analysis.

Book Highlights:

- New investment approach is based on “patterns that predict consistently over the long term”

- Stock Investment model developed for optimizing performance on stock investments

- Market timing model developed for optimizing performance on S&P500 equity index investments

“I had a vision to earn game-changer returns vs. the market by seeking patterns that predict performance” – Joe Furnari

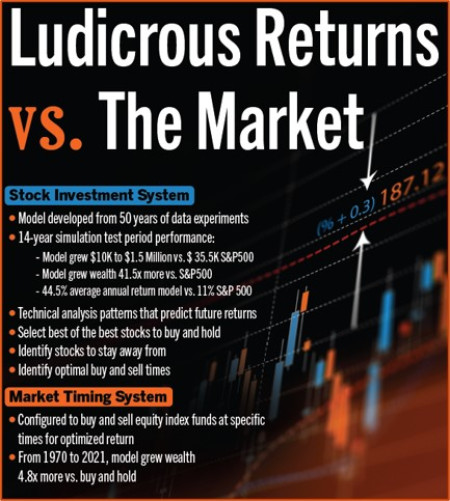

The book describes development of the stock investment model, which includes an in-depth analysis conducted on stock patterns over a 50-year period, from 1970 to 2020. This analysis led to the discovery of “patterns that predict consistently over the long term.” These predictive patterns were also found to be common across stocks of multiple industries and market caps. The book defines these patterns and shows illustrative examples of the high correlation to predict performance.

To prove the stock model effectiveness, a 14-year simulation test from 2007 to 2020. The test results were astonishing. Average annual return was 44.5%, compared to S&P 500 11.1%. This is not a day trading model.

Joe Furnari applied advanced mathematics and statistical techniques to identify chart features with a high probability to future 3-6 month performance. He refined the model and retested repeatedly until the model delivered "Ludicrous Returns vs. the Market." This book provides instructions on how to apply the stock investment model.

The discovery of patterns that predict also led to the development of the market timing model. Tailored for 401K accounts restricted to equity index funds, this model identifies optimal cash vs. S&P 500 equity position. The model is configured to identify when to exit equities ahead of potential crashes and when to re-enter. In a simulated 52-year test spanning from 1970 to 2021, this model accumulated wealth at a staggering 4.8 times the buy-and-hold strategy.

"Ludicrous Returns vs. the Market" will help readers learn how to:

- Create a high-performing stock portfolio.

- Screen for best-performing 15% of stocks and stocks to avoid.

- Identify optimized time to buy.

- Identify strategic time to sell.

- Time the Market buying and selling S&P500 equity index at optimized times.

- Apply the stock investment and market timing models with illustrative examples.

Book is available in Kindle, eBook, paperback or hardcover.

For media inquiries, author interviews, or additional information, please contact: Joe Furnari

About the Author: Joe Furnari has an MBA in Finance and investment experience dating back to the 1990’s. Joe also has an Engineering background and is a data science enthusiast. He has unveiled a revolutionary technical analysis approach to stock trading and market timing in his groundbreaking book, "Ludicrous Returns vs. the Market.”

Source: Ludicrous Returns LLC