A Milestone in Tokenisation: CitaDAO Completes First Real Estate Detokenisation

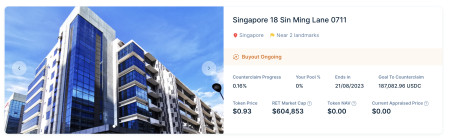

SINGAPORE, August 21, 2023 (Newswire.com) - Leading the way in real-world asset tokenisation, CitaDAO is delighted to share the completion of a buyout of a tokenised real estate in Singapore. The milestone marks the world's first real estate detokenisation. The token holder who initiated the process can redeem the title deed of the tokenised asset. The real estate, located at 18 Sin Ming Lane, Singapore was first tokenised on May 16, 2023, at a value of US$635,000.

Real Estate Token Buyout Offer Summary

Address: 18 Sin Ming Lane, Midview City, Singapore

Date of Tokenisation: May 16, 2023

Buyout Offer: US$604,000

Buyout Dates: July 24, 2023 - Aug 21, 2023

Joel Lin, core contributor at CitaDAO, said, "This milestone shows our commitment to create a reliable and credible real estate tokenisation process. It is critical to ensure the value of the tokens are tethered to the real world asset it represents."

A Step Towards Trustworthy Real-World Asset Tokenisation

Despite the known benefits of tokenisation, the industry remains a niche and few assets have been tokenised. CitaDAO believes for tokenisation to gain more adoption, it has to define a clear path to redeem the asset they represent - ie detokenisation. The milestone achieved is the process of converting the token to the asset it represents. This is similar to how one can redeem USDC (issued by Circle) tokens for real US dollars in their bank account.

The detokenisation process should facilitate a straightforward redemption of the assets. This ensures the value of the token is backed by the asset it represents. CitaDAO believes this paves the way for mainstream acceptance of asset tokenisation. While banks and asset managers are convinced by the potential of the technology, they are not sure how the tangible value of the token is established. This framework to redeem the underlying asset addresses the concern. CitaDAO hopes that this process helps to reduce the risk of real-world asset tokenisation.

Conclusion

CitaDAO is proud to be at the forefront of bridging digital tokens with real-world assets. The detokenisation of 18SML0711 highlights our goal to create a more efficient real estate market. We hope that the process will be the new standard for the industry looking into asset tokenisation. For those with a keen interest in the risk of real estate tokenisation, you can download the whitepaper here

Source: CitaDAO