Dealpath Integrates With iLevel and Surpasses $500 Billion in Real Estate Volume

Deal Management Platform Integrates With iLevel for Portfolio Monitoring and Surpasses $500 Billion in Real Estate Transaction Volume

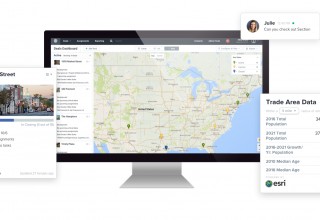

SAN FRANCISCO, May 8, 2018 (Newswire.com) - Dealpath, the leading deal management platform for institutional real estate investment firms, has expanded functionality to seamlessly support customers of iLevel, the portfolio monitoring and fund management software solution from Ipreo.

General partners at real estate private equity firms often use iLevel to track investment performance with real-time reporting. Until now, however, portfolio monitoring and investment pipeline tracking have been managed in separate silos requiring time-intensive manual data entry that is error-prone and quickly out of date. The new functionality will support the flow of data between Dealpath and iLevel, removing the need for redundant data entry thereby streamlining the flow of accurate data and related reporting.

The shared customers of Dealpath and iLevel will now benefit from our best-of-breed solutions designed for interoperability to deliver real value.

Mike Sroka, CEO, Dealpath

“The shared customers of Dealpath and iLevel will now benefit from our best-of-breed solutions designed for interoperability to deliver real value,” commented Mike Sroka, Dealpath co-founder and CEO. “By managing deals on Dealpath and tracking portfolio performance on iLevel, institutional real estate investment firms will have the visibility and controls they need to deliver optimal risk-adjusted returns.”

In addition, Dealpath has now surpassed $500 billion in transaction volume managed on its industry-leading software platform. This latest milestone speaks to the rapid growth and scale of value being achieved.

“This unprecedented market traction reinforces the growing notion that deal management platforms are essential in a modern CRE software stack,” said Sroka. “Dealpath’s intuitive pipeline tracking, collaborative workflow and powerful deal analytics allow investment teams to focus on the value-add work that they want and need to be doing. We’re thrilled that our customers are leveraging the Dealpath platform so successfully to build value.”

Media Contact:

Lou Hong

Email: lou@dealpath.com

Source: Dealpath